What Is Property Insurance?

Property protection gives monetary repayment to the proprietor or tenant of a construction and its items in the event that there is harm or burglary — and to an individual other than the proprietor or leaseholder assuming that individual is harmed on the property. When thinking about property insurance, it's important to understand that there are a few different types of coverage that can protect your property. Each type of coverage has its own benefits and drawbacks, so it's important to choose the coverage that is right for your specific needs.

Property Insurance Coverage

Here are three types of coverage to consider:

1. Homeowner's insurance covers your personal property, such as your furniture and appliances, in your home.

2. Commercial property insurance covers your business's property, such as the building and its contents.

3. Personal liability insurance covers you and any other people who are on the property at the time of a claim

Also there are three types of the replacement of these coverage

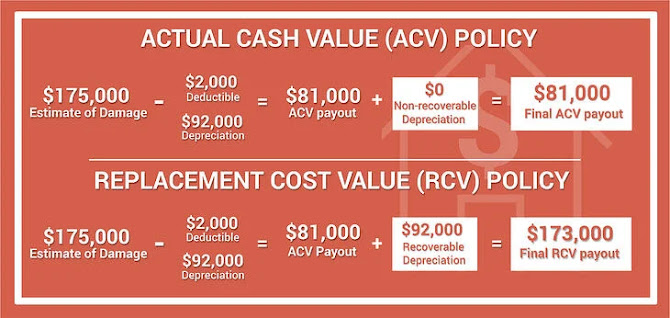

1:Replacement cost

2 Actual cash value,

3: Extended replacement costs.

Replacement cost is the amount a business would need to spend to replace an item, service or piece of equipment that has been damaged or no longer in use. This includes both the upfront cost of the replacement item, as well as the cost of ongoing maintenance and depreciation.

When calculating replacement cost, businesses should take into account the age, condition and type of the item being replaced. For example, a company that replaces computers every three years would likely have to spend more on replacement computers each time than a company that replaces them every six months..

The actual cash value of a car depends on a number of factors, including the make and model, the condition of the car and the mileage. A car's actual cash value can be significantly higher or lower than the car's Kelley Blue Book value.

Extended replacement costs are a big factor in car ownership. When your car is damaged or needs to be replaced, the cost of the new car can be a big financial burden.

How Property Insurance Works

Perils covered by property insurance typically include select weather-related perils, including fire, smoke, wind, hail, impacts of snow and ice, lightning, and more. Property insurance also protects against vandalism and theft, while covering the structure and its contents. Property insurance also provides liability coverage if someone other than the property owner or tenant is injured on the property and decides to sue.

Property insurance policies generally exclude damage from a variety of events, including tsunamis, floods, drain and sewer backup, groundwater, standing water, and many other sources of water. Mold is usually not covered, nor is earthquake damage. In addition, most policies will not cover extreme situations, such as nuclear incidents, acts of war, or terrorism.

Property insurance includes homeowners insurance, renters insurance, flood insurance, and earthquake insurance.

Property Insurance Types

- Auto Insurance

- Home Insurance

- Travel Insurance

- Marine Insurance

Auto Insurance :

Home Insurance :

Travel Insurance:

Special Considerations

Most homeowners purchase a hybrid policy that covers physical loss or damage caused by 16 perils, including fire, vandalism and theft. The coverage, known as an HO3 policy, has certain conditions and exclusions. There is a predetermined limit on the coverage of certain valuables and collectibles, including gold, wedding rings and other jewelry, fur, cash, firearms and other items. HO3 generally does not provide any coverage for accidental wear and tear and mysterious disappearance (lost, lost) of valuables, including fine arts and antiques.

HO5 homeowner coverage covers everything in an HO3 policy, but is geared toward the structure and property within the home, including furniture, appliances, clothing, and other personal items. An HO5 does not cover for earthquakes or floods. HO5 insurance policies are available for homes that were either built in the last 30 years or renovated in the last 40 years, and they generally cover any damages at replacement cost.

HO4 property insurance is commonly referred to as tenant's insurance – it covers tenants from personal property damage and liability coverage. It does not cover the actual house or apartment being rented, which must be covered by the homeowner's insurance policy.

Comments